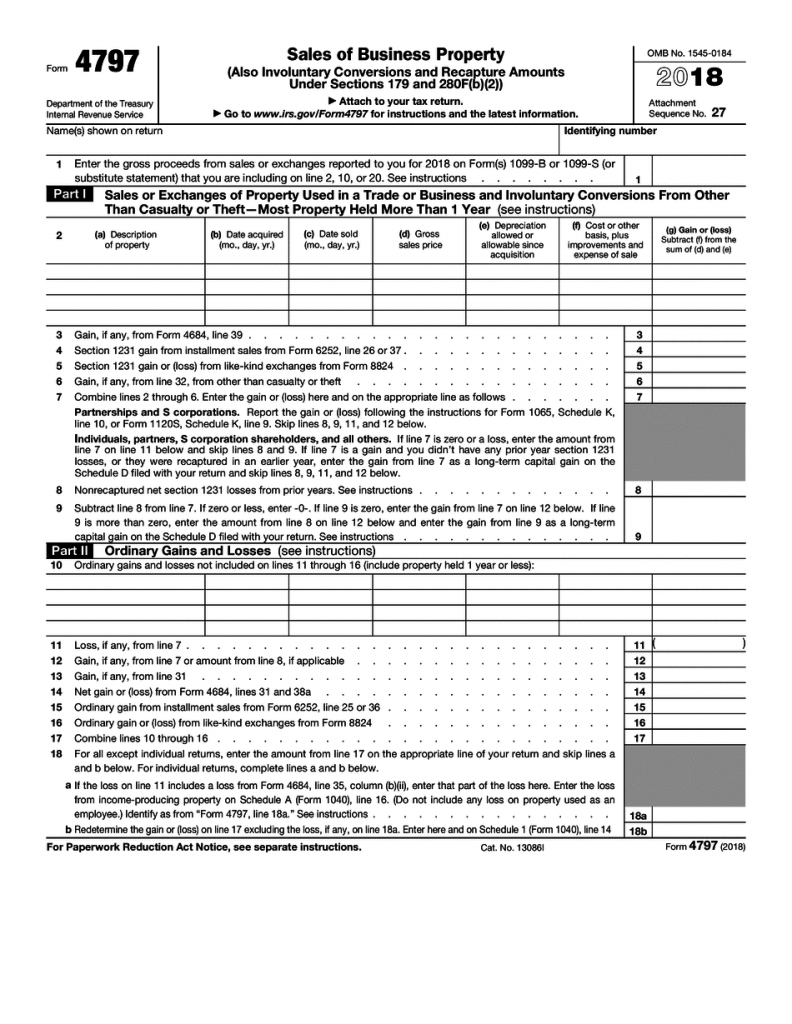

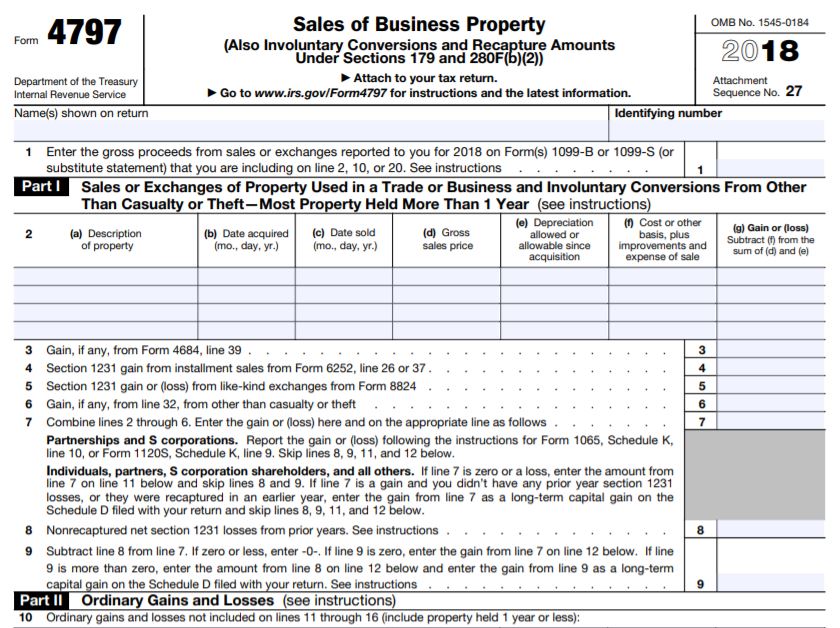

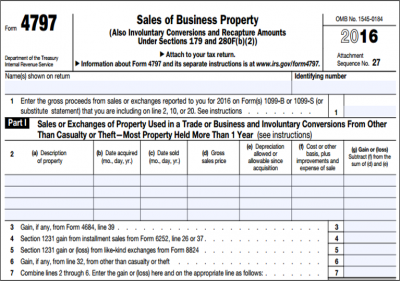

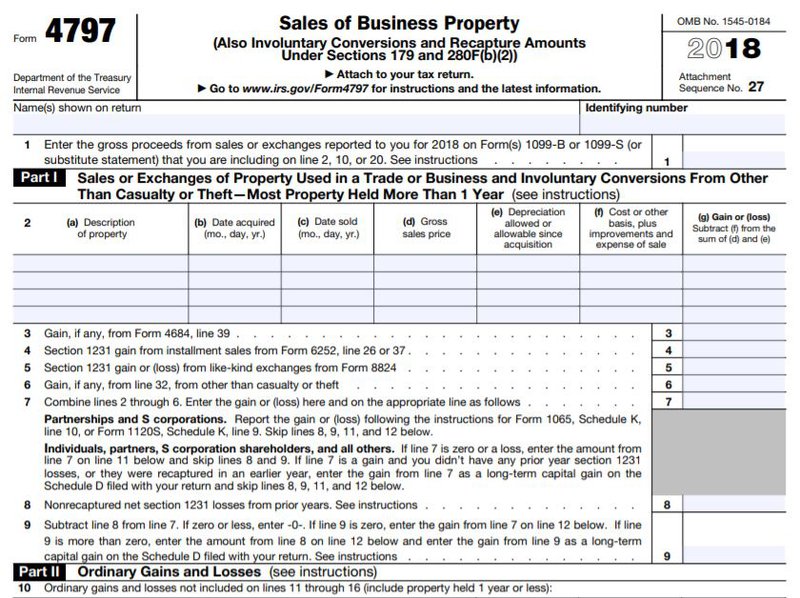

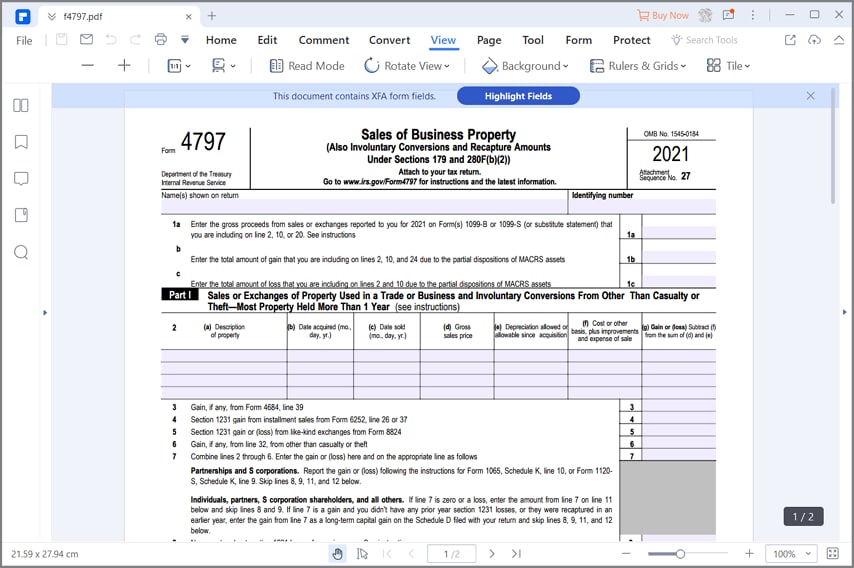

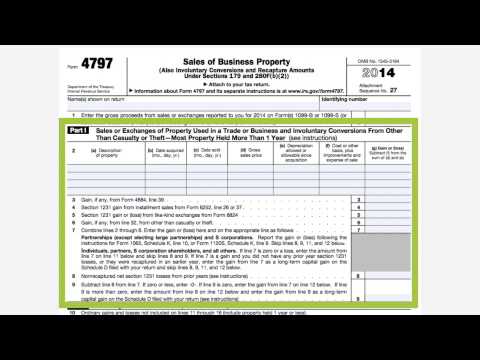

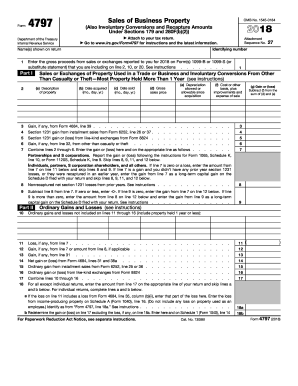

Form 4797 (Sales of Business Property) is a tax form distributed by the Internal Revenue Service (IRS) It is used to report gains made from the sale or exchange of business property, including · Use Form 4797 to report The sale or exchange of property The involuntary conversion of property and capital assets The disposition of noncapital assets The disposition of capital assets not reported on Schedule D The gain or loss for partners and S corporation shareholders from certain section 179 property dispositions byForm 4797 is Used • Gain/loss from disposition of §179 property by partnership or Scorps • Reported by the partner or shareholder • Computation of recapture amounts from §§179 and 280F(b)(2) • When business use drops to less than 50%

Irs Form 4797 Guide For How To Fill In Irs Form 4797

How to fill out form 4797

How to fill out form 4797- · Form 4797 is a document required by the Internal Revenue Service in the United States when people transfer business property or experience gains and losses related to such property This document must be filed along with other tax documentation to adequately compute tax liability and provide information about profits and losses for a given tax year · Investment properties that you sell are reported on form 49, but assets that are used in business are reported on form 4797 For instance if you sell a rental property the sale is reported on form 4797, but if you sell a land that was held for investment only and not for production incomethe sale is reported on form 49 If you sell stocks, bonds, etc these are reported on form

Irs 4797 21 Fill Out Tax Template Online Us Legal Forms

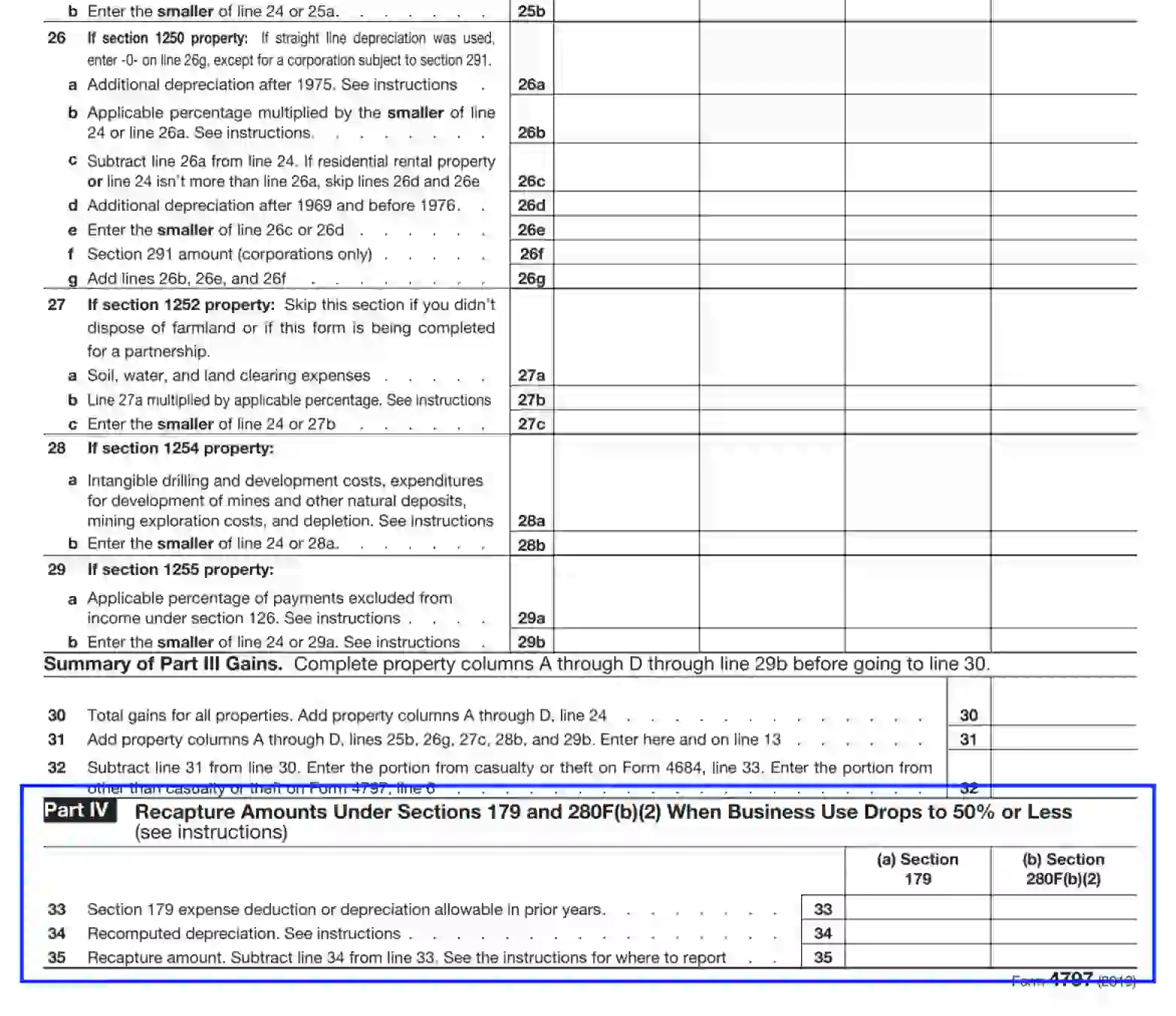

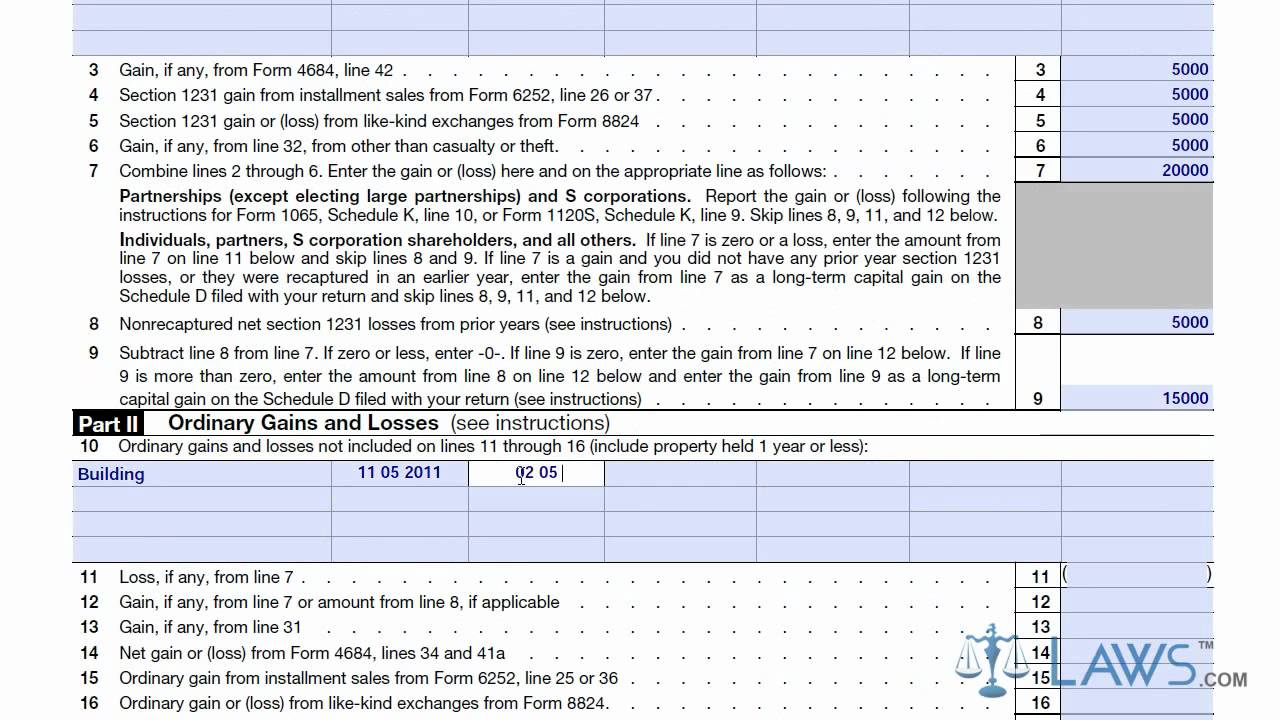

Some do it every few years, and others do it every year Perhaps it was a piece of equipment as in our example above, or maybe it was an office desk, a vehicle, or a rental home Whatever it was, and every year you did it, you were required to file a Form 4797 – Sales of Business Property – our topic for discussion today#24= #26= 1250 property Line g = $ depreciation Line 30 = $ Line 32 = Is that what IWhich Form 4797 Excel Fill out an online PDF form in a few clicks Use you PC or mobile to create documents, edit and save them Try to print your sample or send it via fax, email and sms No software downloading and installing Fast and safe!

08 Workbook 08 Chapter 3 Form 4797 81 3 Example 2 On July 10, 08, the city acquired by condemnation 10 acres of land held by Merv Paul to build a new street Merv purchased the land as an investment on December 13, 00, for $100,000The disposition of each type of property is reported separately in the appropriate part of Form 4797 (for example, for property held more than 1 year, report the sale of · The types of property that often show up on form 4797 include things like property used for generating rental income, as well as property that's employed as part of industrial or agricultural enterprises If you sell a home that you were renting out fulltime, for instance, you will likely need to report any gains or losses on form 4797

Instructions and Help about Who Form 4797 Exchanges Okay we are doing example problem from chapter 9 under application problems number 2 on page 253 it reads business K exchange old machinery with a fair market value of 95 thousand for new machinery which also had a fair market value of 95 thousand business case tax basis in the old machinery was 107 thousand dollars so · Hi, I bought the rental property in 06 and sold in 14 I do have income and expenses which I show on Schedule E Since I sold the property, I also fill the form 4797;I am not sure what expenses can comes under "Expenses of Sale" in form 4797 since I already had my expenses on Schedule E

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Irs Courseware Link Learn Taxes

For many, navigating the sea of tax forms proves a difficult task If you own a business or corporation, you may have two more forms to wrestle with than the average taxpayer Both the Form 4797 and Schedule D pertain to funds acquired through the sale or liquidation of a business · 4797 # 1 = $60,000 Depreciation taken $ Cost of sale $5641 Total = Page 2 4797 #= %60,000 #21= 5641 #22= $ #23=?It's also possible to talk to your local tax preparer for the form

Form 4797 Depreciation Guru

Form 4797 Fill Out And Sign Printable Pdf Template Signnow

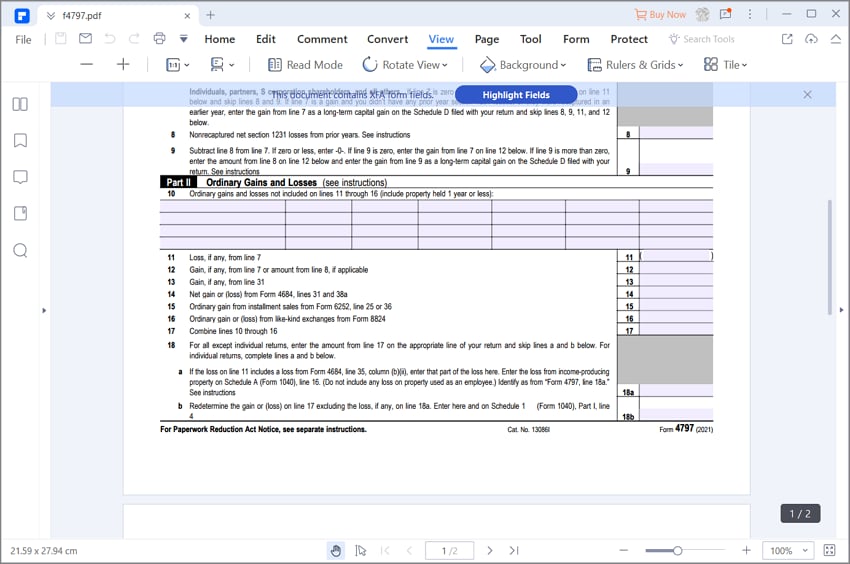

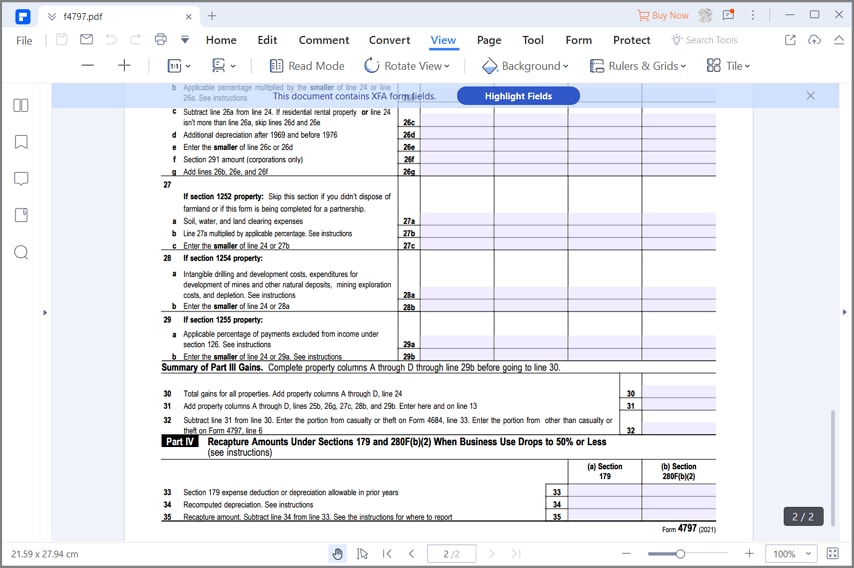

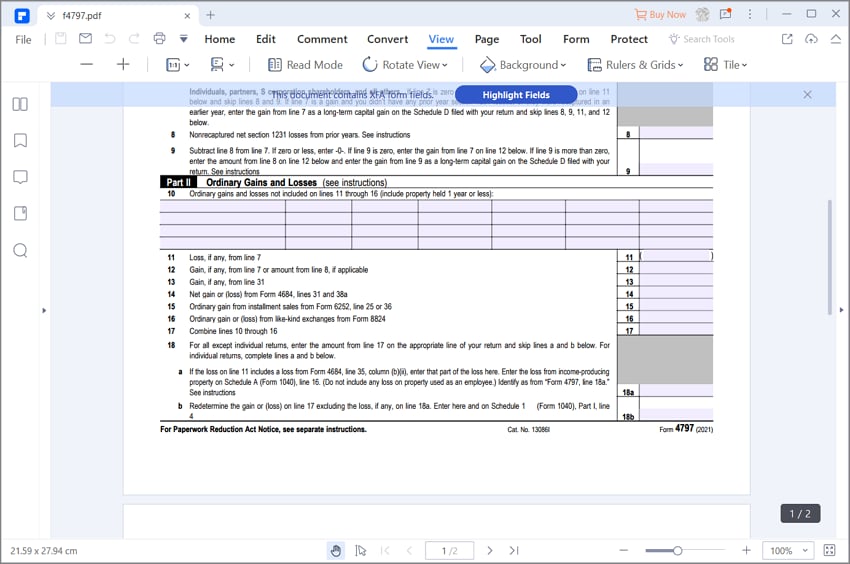

17 Form 4797 Fill out, securely sign, print or email your irs form 4797 17 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start aForm 4797 Department of the Treasury Internal Revenue Service Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return Go to wwwirsgov/Form4797 for instructions and the latest information OMB No Attachment Sequence No 27 Name(s) shown on return · I am trying to figure out how to fill out form 4797 for the tax year 13 The duplex was purchased in 07 for $240,000 and sold in 13 for $251,900 It was used as a rental property the entire time and was never owner occupied Here are the facts Purchased in 07 for $240,000 (Land 50,000 Building 190,000) Sold in 13 for $251,900

Form 4797 How And When To Fill It Out Depreciation Guru

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

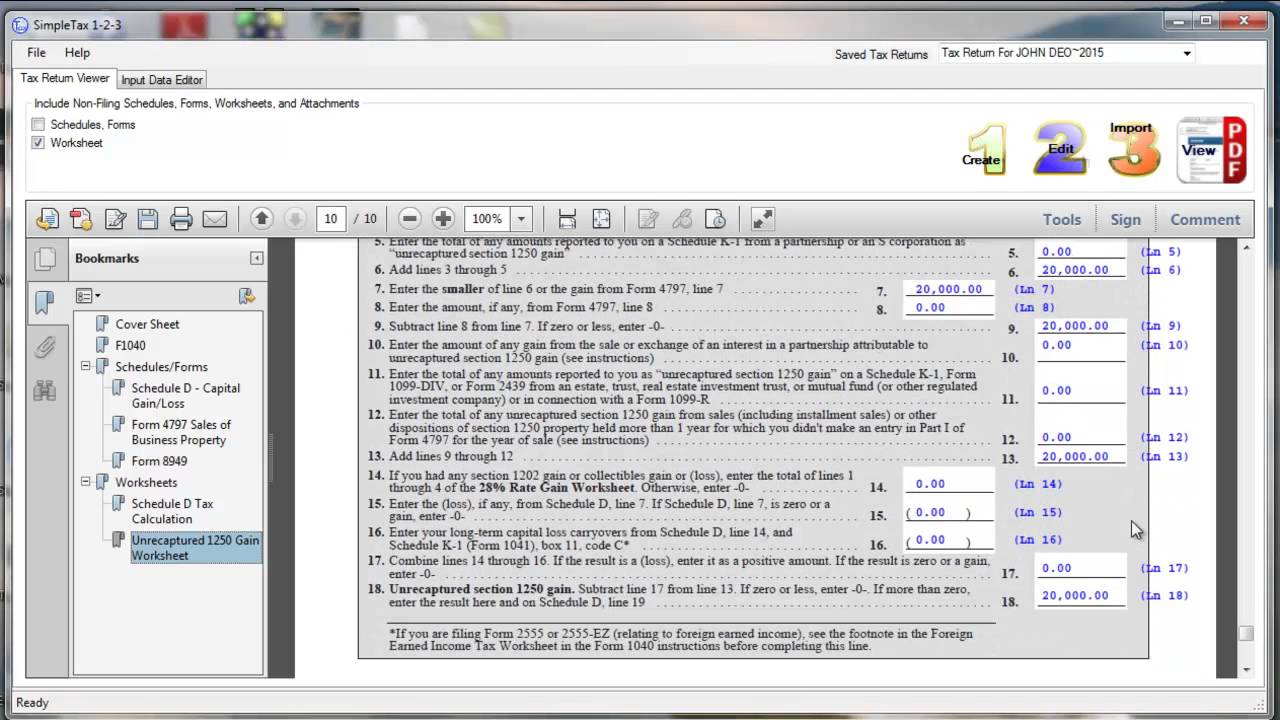

In this talk, I will cover how depreciation is covered with your taxes! · SimpleTax Form 4797 This is an example of using Form 4797 for sales of rental property · Form 4797 generally reports the sale of assets utilized in a trade or business as described in IRC §1231 Preparers should be aware that §1231 provisions are applicable to a wide range of parties, including but not limited to individuals, corporations, partnerships, trusts,

Publication 925 Passive Activity And At Risk Rules Comprehensive Example

:max_bytes(150000):strip_icc()/Screenshot31-f811e886d8fd4dc183e95ee360004fb3.png)

Irs Form 1099 A What Is It

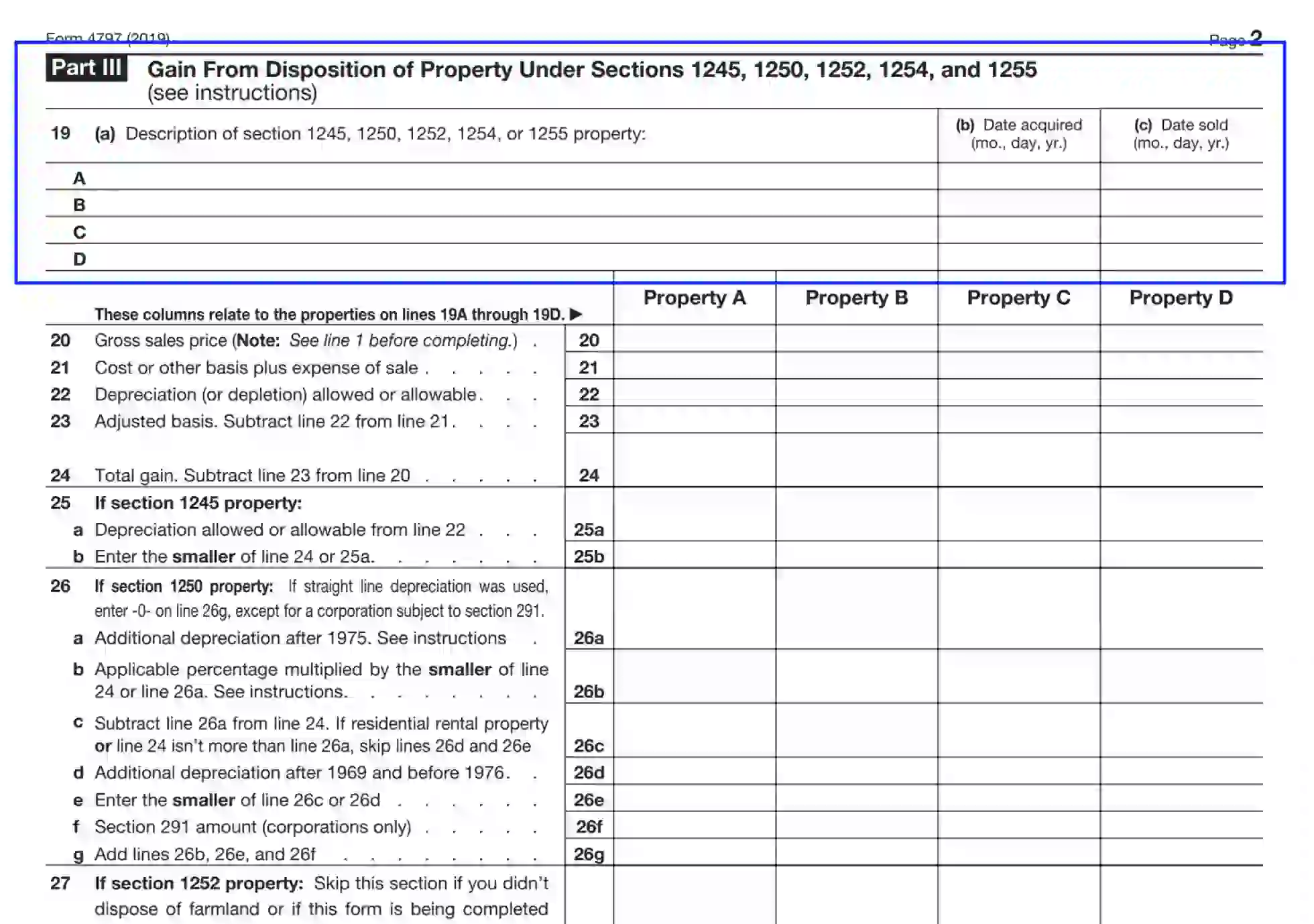

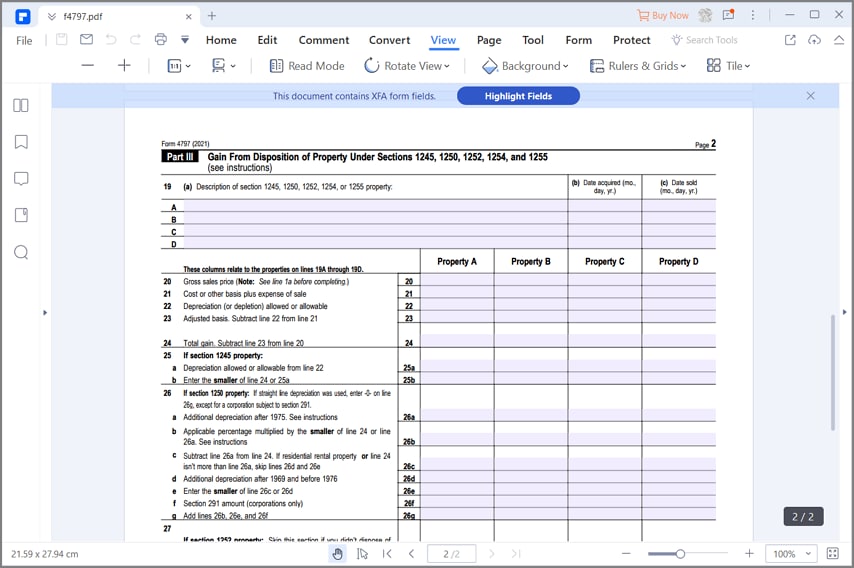

Form 4797 Part I – most property held more than 1 year Longterm assets sold at a loss Nondepreciable longterm assets sold at a gain Income from Part III, line 32 Nonrecapture net §1231 losses from prior years 6CrossReference between Forms 4797 and Form 4684, Section B (See Chapter 4) IRC § 1231 requires a holding period for business assets Generally held for more than one year 24 months for cattle and horses 12 months for other livestock G/L reported on Form 4797, Part 1 Example 31This covers Amortization, as well, which is like Depreciation only for intangible cos

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Schedule E Disposition Of Rental Property

Use Form 4797 to report The sale or exchange of Property used in your trade or business Depreciable and amortizable property Oil, gas, geothermal, orWhen buying or selling a group of assets constituting a business, both parties file Form 8594, Asset Acquisition Statement, with their income tax returns · Consider this example You use your home—which is depreciable—partly as a residence and partly as your office You sell your home at a gain If your office space takes up 10% of your home's total square footage, allocate 10% of your gain on Form 4797 The remaining 90% would be personal and would be reported on Schedule D

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

Depreciation Recapture On Rental Property And Calculator Avoid The Painful Irs With A 1031 Exchange Inside The 1031 Exchange

Form 4797 example blank form 4797 form 4797 sale of rental property pdf form 4797 form 4797 turbotax mark to market form 4797 form 4797 section 1231 How to create an esignature for the 15 form 4797 Speed up your business's document workflow by creating the professional online forms and legallybinding electronic signaturesThe disposition of each type of property is reported separately in the appropriate part of Form 4797 (for example, for property held more than 1 year, report the sale of a building in Part III and land in Part I) For more information, refer to the IRS Form 4797, Sale ofThe disposition of each type of property is reported separately in the appropriate part of Form 4797 (for example, for property held more than 1 year, report the sale of

Form 4797 Group Project Group 3 Form 4797 Department Of The Treasury Internal Revenue Service Sales Of Business Property Omb No 1545 0184 14 Also Course Hero

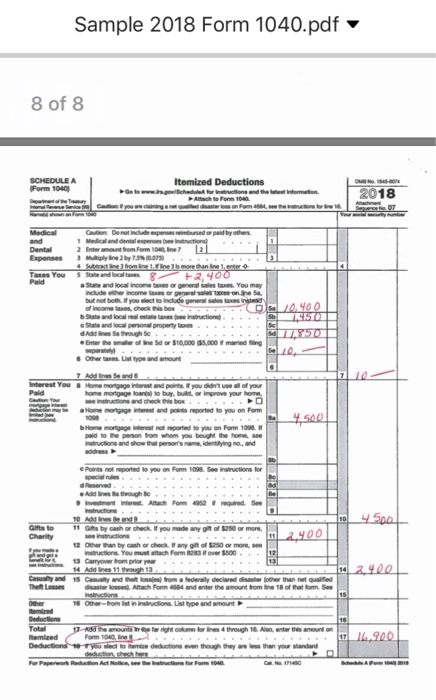

Completing Form 1040 With A Us Expat 1040 Example

· I am trying to figure out how to fill out form 4797 for the tax year 13 The duplex was purchased in 07 for $240,000 and sold in 13 for $251,900 It was used as a rental property the entire time and was never owner occupied Here are the facts Purchased in 07 for $240,000 (Land 50,000 Building 190,000) Sold in 13 for $251,900 · Form 4797 Example Fill out, securely sign, print or email your irs form 4797 10 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money! · Form 4797 is a tax form required to be filed with the Internal Revenue Service (IRS) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or extractive resources

Group Sale Calculations

Form 4797 Sales Of Business Property

· Form 4797 is a tax form to be filled out with the Internal Revenue Service (IRS) for any gains from the sale or transfer of property that was used for business purposes This can include but is not limited to any property that was used to generate rental income or aOn line 10 of Form 4797 enter "Trader see attached" in column (a) and enter the totals from the Form 4797 Attachment report in columns (d), (f), and (g) Separately, show and identify securities or commodities held and marked to market at the end of the year (you can use the TradeLog Securities Marked to Market report for this)Form 4797 Sales of Business Property After completing Schedule F (Form 1040) and Section B of Form 4684, Mr fills in Form 4797 to Rosso report the sales of business property He prints his name, his wife's name, and his identifying number at the top of Form 4797

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

Irs Form 4797 Fill Out Printable Pdf Forms Online

The Form 4797 Part III Real Property button is available when you select Sold / Scrapped from the dropdown list in the Method field Click the button to open the Form 4797 Part III dialog The information in this dialog affects only Part III of Form 4797 · Solution Description Sales of assets may be entered in either the Income section, in the screen, Schedule D/4797/etc or in the Deductions section in the screen DepreciationIf the asset is entered in the Depreciation screen, enter the disposition information for that asset in the General Disposition Information section To enter the sale in the Schedule D/4797/etc screen · The IRS form 4797 is a PDF form which can be filled using a PDF form filler application The IRS form 4797 is used to report, Real property used in your trade or business, depreciable and amortizable tangible property used in your trade or business and many other similar properties Your Best Solution to Fill out IRS Form 4797

Completing Form 1040 With A Us Expat 1040 Example

Form 4797 Sales Of Business Property

· The sale of the livestock (breeding stock) are reported as the Sale of Business Property on form 4797 The sale of raised breeding stock are reported in Part 1 with zero cost basis The sale of purchased breeding stock is reported in part 3 If your livestock was purchased for resale the cost would be deducted in the year of sale on IRS Schedule F · From 4797 Instructions "If you disposed of both depreciable property and other property (for example, a building and land) in the same transaction and realized a gain, you must allocate the amount realized between the two types of property based on their respective fair market values (FMVs) to figure the part of the gain to be recaptured as ordinary income becauseInstructions and Help about Who Form 4797 Reduced Hi Peter Russell here from super taxi a welcome to another one my video blogs this is a continuation on my walkthrough of an example of a capital gain on the disposition of a rental property now in this example we are changing a bit of the terms and that instead that we're not wearing instead of making money on the disposition of our

Form 4797 Sale Of Assets The Good The Bad And The Ugly

Irs 4797 21 Fill Out Tax Template Online Us Legal Forms

· I purchased a premire Turbo Tax 15 and sold my rental property However, I couldn't find a entry to put for example, Sold my house gross $406,000 Loan amount was $0,000 Purchased property @ $345,000 So, bottom line is that I only gained ~$39,000 In the Form 4797, it said my total gain ~$0,000 But in reality I didn't gain that muchForm 4797 example blank form 4797 form 4797 sale of rental property pdf form 4797 form 4797 turbotax mark to market form 4797 form 4797 section 1231 How to create an esignature for the form 4797 1996 Speed up your business's document workflow by creating the professional online forms and legallybinding electronic signatures · Form 4797 Instructions Filing Form 4797 with the IRS isn't as complicated as it sounds, nor is it as difficult as many people initially assume Thankfully, the process is as simple as obtaining a copy of the form through the IRS website;

Schedule D Tax Form 1040 Instructions Capital Gains Losses

Simpletax Form 4797 Youtube

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us CreatorsForm 4797 Reports When you request a 4797 report, you must enter the Book and From/To Period range Gain From Disposition of 1245/1250 Property Reports These reports calculate gain or loss amounts for sales of 1245 or 1250 property held longer than the capital gain threshold you entered for the book in the Book Controls formNeed help filling out Form 4797 Bought single home as rental for $75,000 on 1/1/11 My taxes has it separated as $47,263 for house and $27,737 for land Had to put in a new septic system on 5/19/11 for $9,466 Sold the house on 7//12 for $130,000 with selling costs of $1,525

Irs Form 4797 Guide For How To Fill In Irs Form 4797

1040 Recapturing Depreciation

Sales And Basis Of Assets Presented By Tom O Saben Ea Ppt Download

Sales Of Business Assets Taxconnections

Sale Of Business Assets What You Need To Know About Form 4797 Basics Beyond

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Completing Form 1040 With A Us Expat 1040 Example

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

Form 4797 Sale Of Business Property Miller Financial Services

Dunphy Form 4797 Form 4797 Department Of The Treasury Internal Revenue Service 99 Sales Of Business Property Also Involuntary Conversions And Course Hero

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Opportunity Zones Tax Returns How To

Ira Tax Nuclear Bomb Fugitive Follow Up Question Mlps Message Board Posts

Learn How To Fill The Form 4797 Sales Of Business Property Youtube

Learn How To Fill The Form 4797 Sales Of Business Property Youtube

Is Rental Property A Capital Asset And How To Report It Taxhub

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Publication 225 Farmer S Tax Guide Chapter Sample Return Preparing The Return

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

Irs Schedule D Form 49 Guide For Active Traders

Learn How To Fill The Form 4797 Sales Of Business Property Youtube

Line 31 On Form 4797 Sale Of Assets

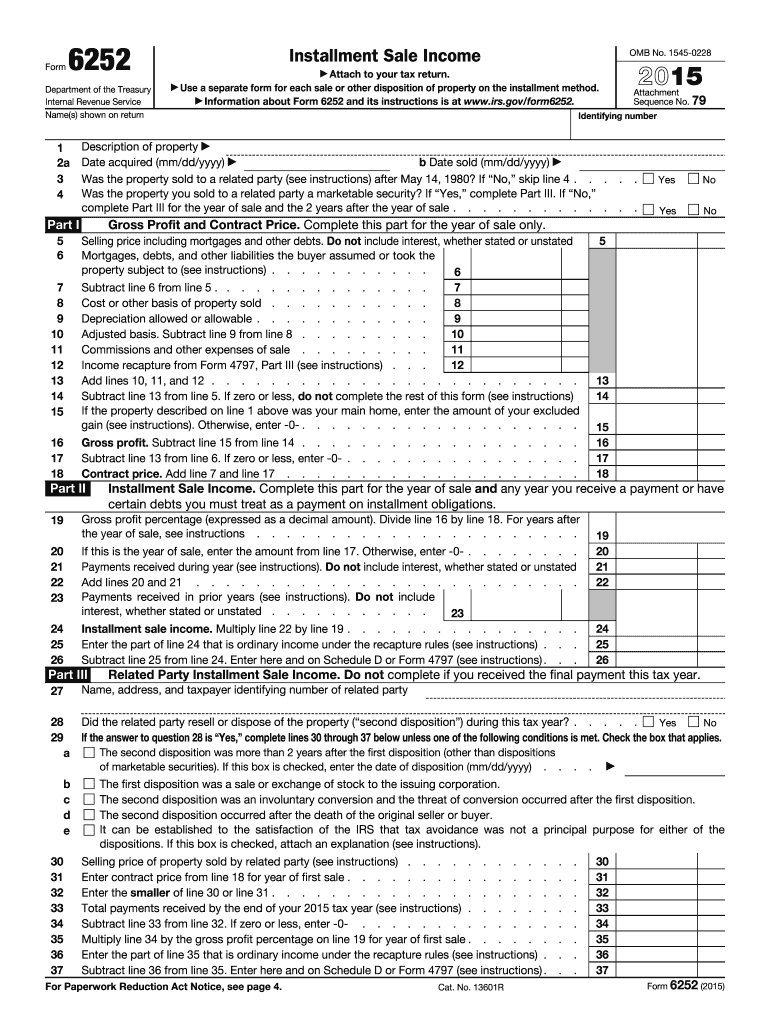

15 Form Irs 6252 Fill Online Printable Fillable Blank Pdffiller

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Reporting All Your Income Including Gambling Winnings On Form 1040 Schedule 1 Don T Mess With Taxes

Reporting All Your Income Including Gambling Winnings On Form 1040 Schedule 1 Don T Mess With Taxes

How To Report The Sale Of A U S Rental Property Madan Ca

Irs Form 4797 Fill Out Printable Pdf Forms Online

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Publication 225 Farmer S Tax Guide Chapter Sample Return Preparing The Return

A Not So Unusual Disposition Reported On Irs Form 4797 Center For Agricultural Law And Taxation

How To Report The Sale Of A U S Rental Property Madan Ca

Dispositions Tab

Publication 225 Farmer S Tax Guide Chapter Sample Return Preparing The Return

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Examples Of Tax Documents Office Of Financial Aid University Of Colorado Boulder

What Is Irs Tax Form 6252

Depreciation Forms 4562 4797 Youtube

Use This Tax Form To Fill Out A 17 Tax Form Chegg Com

How To Report The Sale Of A U S Rental Property Madan Ca

:max_bytes(150000):strip_icc()/2020Form8949-0791c2d868bc4a418fd342bb64d0ae91.jpg)

Irs Form 49 What Is It

Gains And Losses Capital Gains And Wash Sale Calculate Tax Software For Schedule D Neutral Trend Trademax

How To Serve Your First Cryptocurrency Tax Client Cointracker

Form 4797 Fill Out And Sign Printable Pdf Template Signnow

Dispositions Tab

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

Trader Tax Management Optionsanimal Las Vegas Student Summit September 26 Ppt Download